5 min read

Like most industries, digital transformation is changing insurance. Journalist, Polly Jean Harrison, writing for the Fintech Times on 5th May 2022 about ‘The Top Tech Trends Transforming The Insurance Industry’ therefore claims it has never before been riper for disruption than it has today. The charge for change is being led by Insurtech startups who lead with technology-first approaches. Arguably though, they need to lead with customer-first approaches by initially understanding how the implementation of technology impacts on customer experiences of insurance brands.

This industry shake-up is nevertheless expected to change the industry forever. The start-ups are working on augmenting legacy systems, increasing robotic process automation (RPA), low-code/no-code developments, tailored digital products, and then there is Spixii’s ability to offer Conversational Process Automation (CPA) and its expertise in enhanced Conversational Self-Serve Technology.

Leverage Self-serve and Conversational Process Automation to improve the customer experience and operational efficiency, read Spixii’s eBook on ‘How to enable true self-serve in insurance’ with Conversational Process Automation and Conversational Self-Serve Technology.

Harrison writes:

“Insurance companies are in a “digital race” as they rush to innovate to support better customer experiences. Agility has become a baseline to mark competitiveness in today’s insurance space... [insurance] companies are exploring AI-enabled tools to automate estimation and inspection. One instance of this is the use of telematics to offer greater levels of contextual information to aid smoother, faster, and more comprehensive claims settlements.”

“More and more agents and brokers are turning to digital tools; at the same time, customer demand is skyrocketing with the emergence of self-service digital channels. A McKinsey survey conducted in 2020 of European insurance executives, revealed that 89 per cent of respondents expect a significant acceleration in digitisation, and most also foresee a further shift in channel mix.”

She argues that the fully tech-enabled insurers of the near future will be unrecognisable when compared to today’s organisations:

“The fact of the matter is that inefficient, manual processes have to go. Paper-pushing may have been the norm in the insurance industries for centuries, but this is no longer feasible. These archaic channels cannot be seen as necessary evils anymore, with digital solutions right here under our noses and being normalised more and more each day.”

Putting the customer first

However, the focus shouldn’t be just on an insurer’s own goals of, for example, making processes and operations more cost-effective for its own benefit. Overall, streamlining processes is vital. Yet there is a need for efficiencies in the way that insurance customers can buy insurance products, discuss issues, find information, make queries, or make insurance claims with simplicity and without frustration caused by queueing or being passed from pillar to post by an agent.

Customers should be able to use the technologies they are comfortable with, and so insurers should allow them to communicate and interact with them through their preferred channels, and in a way that adds value. This may be by phone, by email, interactive voice response (IVR), web forms, chatbots, live chat, or via a combination of these channels. Self-serve should therefore be more about offering customers convenience 24 hours a day across the year than about just using technology to make business processes efficient without any consideration for how they impact the customer.

Capturing conversations

Remember, each interaction with insurance customers offers an opportunity to capture a conversation and subsequently data that can allow for the better use of technology to improve the customer experience. By improving the customer experience, insurers will be able to increase the opportunities for capturing conversational data, which can enable them to offer new products and services, permit the appropriate improvement and automation of processes, as well as to measure whether the products they are offering and how they are offering them, are right for their customers.

Which channels and technologies allow self-serve?

The channels that allow customers to self-serve include online web forms, chatbots, and other technologies such as IVR. Web forms are very much like the paper forms people used to fill in before digital transformation. Web forms are no different and offer no opportunity for a conversation or automation. So, for home insurance, a web form can’t provide all the information that’s needed in a structured and well-presented manner – particularly on a small smartphone screen. Quite often, unless adapted for mobile use, they can only be used by customers on a laptop or desktop PC.

In contrast, IVR still allows an end user to communicate on the phone. Most of the time IVR is for channelling to the right human, and it can take a long time. Whereas with conversational self-serve through chatbots, the strength of the web form and of the IVR can be used to keep the conversational aspects of each customer interaction with insurers. This approach creates a really rigid experience, and conversational self-serve can execute a range of processes.

The trouble is that the data and information from most conversations with customers are often not captured. Conversational Process Automation and Conversational Self-Serve don’t stop the conversation; they enable it and permit insurers to capture the data from each customer interaction. These technologies capture conversations in a way that allows insurers to improve customer experience, create new digital insurance products, and business processes through innovation.

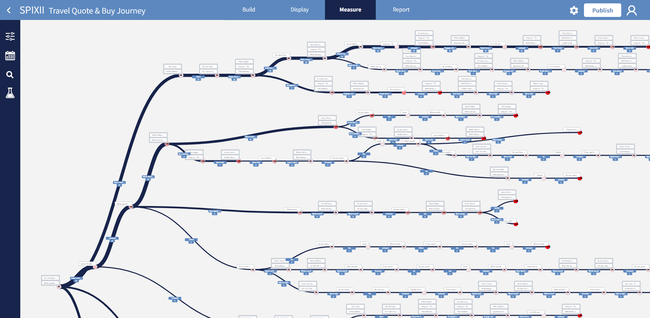

Digital footprints generated by a chatbot on Spixii CPA platform for each conversation journey

Customers: Self-Serve preferred

Scott Clark writes in his CMS Wire article of 2nd June 2022, ‘4 Self-Service Trends That Are Changing Customer Service’ – citing research by CGS, a global provider of business applications, enterprise learning, and outsourcing services – that consumers would prefer to handle more tasks themselves. The company claims its key finding is that customers often prefer self-service when it’s offered.

Clark adds:

“It’s not that customers just want to handle things themselves — what they are really after is convenience and speed. When it comes to customer service, they want solutions to their problems, or answers to their questions — and they do not want to have to put forth much effort in order to do so, nor do they want to spend much time on the task.”

That’s also Insurance companies’ experience, and that’s why self-serve technology and CPA offer insurers the opportunity to improve the customer experience, their operational efficiencies, their competitiveness, and their profitability. By keeping up with customer and technology trends, insurers won’t just be keeping on with the times; they will be demonstrating a keenness to evolve and to add customer value. This begins with decision-makers assessing the impact of technology on their customers and on their organisations so that they can leverage the benefits of Insurtech to their full potential.