3 min read

Peter Drucker, management guru and the author of 30+ books on business, once said:

“If you can’t measure it, you can’t improve it.”

This goes for each and every business, no matter its nature or niche.

Zooming in, one of the biggest challenges insurance companies are facing is the poor quality of data. Data quality is critical to improving operational efficiency and deciding on marketing strategies.

The importance of data

Data inconsistency creates operational weakness that leads to high costs in terms of both time and energy.

An example: the claimant enters wrong data in a form because they don't understand the question and there is no one to ask. Due to this, the operator is not able to execute the claim process. The claim handler will then need to call the customer to correct the information. Contacting the customer after the notice of loss is costly. It is also very likely to drive low customer satisfaction as the customer will have to repeat the process of providing information. The repetition wouldn't have been necessary if proper and robust processes had already been in place.

The main difference is that the claim handler will address the pitfall of the digital claims process through a one-to-one conversation. Although it can fix the situation, it is not scalable. Identifying issues as soon as they arrive is the first step. Yet being able to measure it is a necessary condition to act upon identification.

Accenture captures the importance of data like this:

“How can insurers become data-powered companies? Investing in key digital technologies to unleash data value is critical. Our research shows that the companies that are gaining the most competitive advantage from new technologies are almost all investing in cloud computing, big data analytics, real-time data, data lakes and artificial intelligence (AI). These technology leaders invest far more in innovation than their less progressive counterparts. They also adopt new technologies much quicker. This enables them to scale innovation across their organizations quickly. What’s more, they can adapt to sudden threats or opportunities.”

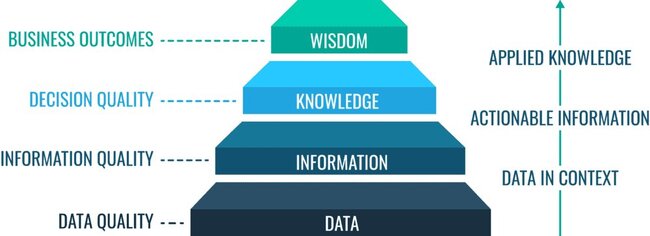

Thus, data is an essential foundation for a lot of business success. It can also be said that business wisdom is acquired through a ‘waterfall process’ that starts from data.

Thus, using data to inform business decisions only works when the data is correct.

Where things go wrong

Historically, poor data quality has been a thorn in the side for insurers. This is primarily because large amounts of unstructured data is stored in a variety of systems. Many of these systems are legacy (antiquated) systems and others are actuarial software (desktop based). When new applications and features are added to these legacy systems, it only compounds the problems and makes the architecture redundant. Additionally, data structures, data models, and data definitions are also lacking.

In a research commissioned by Experian Data Quality in 2013 the top reason for data inaccuracy was found to be human errors, with 59 % of cases assessed to be stemming from that cause.

Having many old systems derail the attention of the business. They end up focusing more than they should on keeping traditional processes running, instead of being customer-centric. Sticking to old ways of working is not customer-centric.

By not being customer-centric, customer-facing processes are limited by poor performance and create unnecessary interaction with customers. The more interaction with the customers, the more it costs the business. Therefore, such interactions should be precise, smooth and digital as much as possible.

Conclusion

Validating the data when it is captured in first place then validating before passing it to core insurance systems is crucial is delivery effective business process automations. See here how Spixii Conversational Process Automation platform can help acquiring good quality structured data for customer-facing processes.