The ultimate guide to Conversational Process Automation (CPA)

What is Conversational Process Automation (CPA)? How is it boosting customer experience across all the customer-facing interaction touchpoints? What tangible business benefits can it drive?

Discover everything you need to know about CPA and how it can help your business to meet your customer's expectation at a fraction of the cost.

Navigation Menu

What is Conversational Process Automation?

Conversational Process Automation (CPA) refers to the management of customer-facing processes and optimisation of such processes through automation strategies.

The term “Conversational” indicates the communication between an individual and a business via automated systems like chatbots. The communication develops into a two-way system, therefore CPA can be applied in both directions: when an individual performs queries to a business and when a business needs to communicate with an individual.

The role of CPA is to improve the efficiency of customer-facing processes by automating them either fully or partially. Usually, this involves an expert chatbot that interacts with customers, collects their input and delivers it to the business in a structured format, easy to handle. Most of the time CPA is integrated with core business processes and systems or can even allow straight-through-processing (STP).

Examples of CPA integrations include connection with automation platforms (e.g. RPA & low-code automation), insurance platforms (e.g. policy, billing and claims) and on-premises applications (claims and policy systems).

Moreover, CPA brings a scientific and evidence-based approach into the equation by leveraging customer data insights and advanced analytics. Examples of this include quantitative feedback analysis (e.g. TNPS - Transactional Net Promoter Score or CSAT - Customer Satisfaction), qualitative feedback (e.g. verbatim feedback), behavioural analytics (e.g. how the chatbot is performing according to demographics, how are individuals interacting with the chatbot etc.). Such insights become the ground for continuous improvement and inform on how to optimise the end-user conversational experience but also, more widely, how to improve the underlying process.

To deepen, read the blog Conversational Process Automation: what is it and how is it better?

What are the benefits of CPA?

Higher performance

Through automation, CPA allows the reduction of operating costs while increasing productivity: a CPA expert chatbot never sleeps and makes consistent actions, zero deviation from the intended purpose. This means providing a streamlined, wholesome customer experience while drastically reducing process inefficiencies, with all the unnecessary steps. No more unnecessary waiting time or input errors: CPA populates systems with structured data or even performs straight-through processing (STP).

Lower operating costs

When you have automated interactions with customers through CPA, then the operating costs automatically slide down. The notion of time spent over the phone is not relevant anymore as the digital channel is fully utilised. The focus shifts to customer satisfaction and the ability to chat with thousands of customers at the same time. Part of the weightlifting is delegated to a resource that can serve multiple customers at once. Costs are reduced by 50 to 75% at once, making CPA a much performant solution at a fraction of the cost.

Higher efficiency

One operator can only serve one customer at a time because extensive and detailed answers can only be given one by one. This pace cannot be compromised upon because the quality of service rendered at this point will determine customer satisfaction whilst also requiring a lot of personalisation.

In contrast, an expert chatbot will attend to each customer with detailed answers to their query while seemingly paying complete attention to them. When linked to core insurance processes or systems through CPA, expert chatbots can also automatically and instantly perform specific tasks. Human beings aren’t capable of such levels of multitasking yet they need support.

Depending on the use case and on the level of automation, CPA can either function independently or together with operators. Let’s take claims as an example. An expert chatbot can be at the “front desk” to manage the first notification of loss (FNOL), gathering all the information related to the claim and open tasks for claim handlers through CPA. Alternatively, especially for low-value and simple claims, CPA can be applied to perform straight-through-processing (STP) and perform adjudication or even payout. CPA can be both an independent or complementary solution: the choice is up to businesses.

Higher customer satisfaction & retention

No one likes to wait over the phone for ages or to fill a clunky and not responsive form - no one wants to be subject to such painful processes. CPA improves customer experience by adding a “voice” to such process-heavy business interactions, enabling a better connection with policyholders through a simpler experience. Also, thanks to the employment of expert chatbots, CPA has proven a much higher feedback collection rate. From quantitative feedback (e.g. TNPS - Transactional Net Promoter Score) to qualitative feedback (e.g. verbatim feedback), expert chatbots can provide customer insights along with behavioural patterns.

Besides, when clients sense that a brand/ company/ organization is dedicated to listening to their queries, clearing their doubts, and spending time developing trust, they automatically uplevel to loyal customers who not only repeatedly purchase from you, but also toot your horn where your voice can't reach. This unpaid, word-of-mouth marketing is golden and is the secret sauce to many successful businesses. Because of a higher personalised service along with all the other conveniences, the rate of customer satisfaction will only go up.

2022 White Paper

Discover how to enhance insurance with the automation of conversations and processes.

Continuous improvement

CPA is a dynamic automated solution designed to execute customer-facing business processes, detect weaknesses and optimise their performance. Through a solid data-driven approach, it empowers businesses to systematically analyse chatbot customer interactions through dedicated analytic dashboards and reiterate the conversational experience with its underlying processes. In other words, CPA provides a continuous evidence-based improvement loop with the chance to quickly adapt the conversational experience to customers’ demands and expectations.

This means that whilst executing the business process itself, all the data gathered from expert chatbots are structured and wrapped into meaningful insights. Such insights become the knowledge base for businesses, allowing them to gain better knowledge of their customers and the performance of the processes they are subject to, and eventually improve both.

Lower maintenance

Whenever it comes to updating content in traditional systems such as web forms or web pages, time is one of the main problems. Not only the approval process according to regulation guidelines (IDD & GDPR) but also the implementation of change itself requires long times. Depending on the type of content to change, the update often requires passing through different environments (e.g. development, test, production).

CPA changes the rules of the game by moving from a static and rigid system to a dynamic one. After providing meaningful insights, CPA allows businesses to update the content of customer interactions 80% quicker, ensuring flexibility and business resilience. What is too rigid can break and rapid iteration gives the flexibility for insurers to adapt and become more resilient with a lower need for maintenance in comparison with legacy systems.

365/24/7 availability

A chatbot solution doesn’t need coffee or toilet breaks or 8-hour sleep. This is a huge bonus for insurance companies with overseas customers as well as companies wanting to serve demographics such as millennials and workers mainly being available outside the classic 9 am to 5 pm. Most of the people are not able to call insurance companies as they are working during call centre opening times, or some are working overnight and sleeping during the day.

For example, if someone needs to open a claim, an expert chatbot can be employed to allow the first notification of loss (FNOL) at any time. Also, this means no hold times independently from the number of requests. As proof of this, you can see how Spixii’s Zara chatbot in collaboration with Zurich UK was successful in absorbing 2018’s Beast from the East surge.

Easy understanding

Insurance is complicated and the average customer with poor knowledge over demands to be guided through all steps of the insurance value chain. One main limitation of webforms is the inability to communicate with the end-user as an agent does. Trying to create a conversation using a webform is simply impossible, yet most of the insurance queries are solved via a meaningful conversation over the phone.

Through expert chatbots, businesses can keep two-way communication at scale. This is because they offer a meaningful experience to customers empowering them to make guided yet non-advised informed decisions quickly and easily. Within a conversational experience, insurance jargon can easily be explained and grey areas clarified.

Tailored experiences

When powered by CPA, expert chatbots allow personal experiences with customers and policyholders. No more one-size-fits-all interactions: thanks to its flexible system, CPA ensures a tailored experience to accommodate customer’s needs. Take the example of a quote & buy conversation for a health insurance product: after the collection of data related to medical conditions, expert chatbots are able to answer customers in a more comprehensive way. There will be fewer of the cookie-cutter answers and more of the personalised ones that provide actual value to customers.

Also, every digital interaction varies according to the device that is used. CPA optimises the interaction according to the device thanks to its chatbots responsive design.

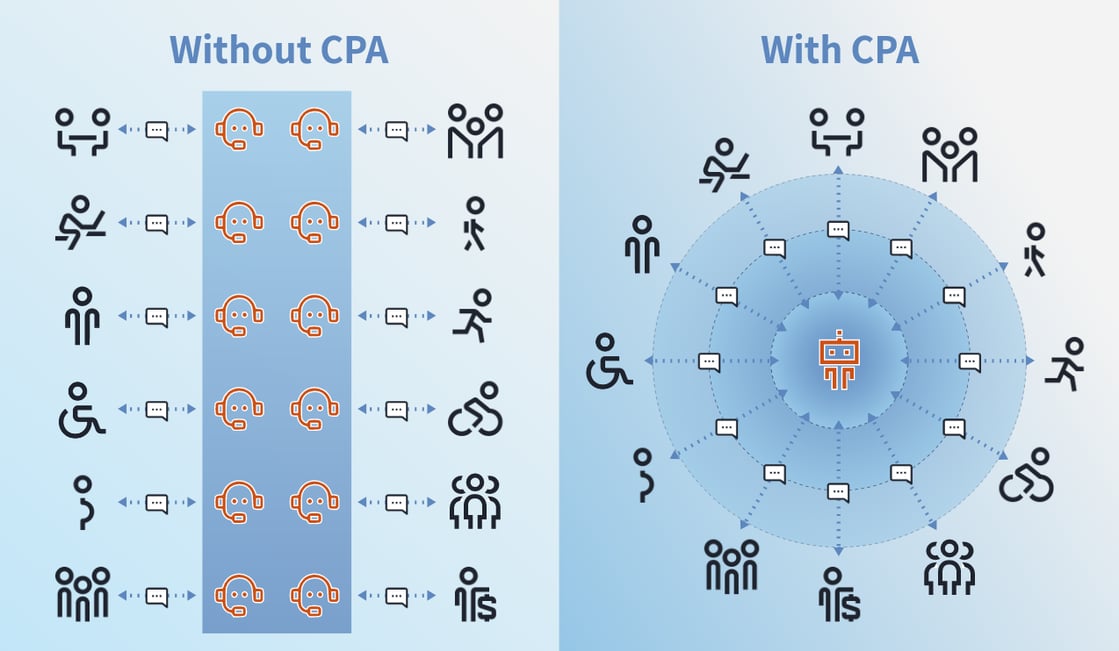

How is CPA uniquely different from insurance’s traditional channels?

Insurance is a highly transactional business between a customer and a company. Because of its complexity, communication is necessary across all the steps of its value chain: when a customer is about to enquire, buy, manage a policy or make a claim.

To date, different channels are involved to manage such communication. Let’s see how they are performing compared to CPA.

Call centres provide an overall good and personal user experience yet they saturate quickly causing customers to wait. No one likes waiting and complaints are inevitable, ultimately damaging the reputation of the brand. The only way to overcome this problem would be to have one operator per customer, which is not viable business-wise.

Webforms and portals provide a good business performance by leveraging digitalisation to automate processes that were once performed manually. Yet webforms lack the personal conversation of call centres reducing them, essentially, to digital monologue. Customers today expect more than impersonal and clunky interactions.

Live chat empowers human agents to manage multiple personal conversations at the same time. It empowers and scales call centres. Yet, each agent can manage a maximum number of 4 conversations causing long waiting times. Web live chat suffers from the same constraints as call centres, it only raises the threshold higher.

CPA allows the optimum performance by preserving the personal conversation for a good customer experience, yet delivering it digitally at scale, maximising the business performance. CPA enables an unlimited number of personal and consistent conversations at a fraction of the cost of the analogue ones.

It is important to highlight that CPA is not meant to substitute all the other channels, on the contrary, it is a complementary solution that can easily sit into an existing ecosystem. The focus of CPA is to remove hiccoughs in customer interactions by reducing processes inefficiencies and streamlining isolated and unconnected traditional processes.

To deepen, read the blog How to evolve conversations with customers from analogue to digital?

How CPA leverages analytics for continuous improvement

The CPA framework has been shaped on the build-measure-learn loop concept, with a key focus on evidence-based and data-driven improvements. In practicality, expert chatbot conversations execute business processes while feeding the CPA platform with huge amounts of data. The platform visualises such data in a simple and meaningful way in order to uncover insights on how to improve the process and the conversation itself, giving the chance to perform quick iterations with AB testing capabilities.

Expert chatbots are able to collect vast amounts of data (much more than a simple website). When linked to CPA platforms, such data become visible through visual representation and graphs that help insurers to generate multiple customer insights, some of which are unprecedented. Among them:

Detailed demographics

All customer data collected through expert chatbots is securely stored in a database. Whilst being anonymised in order to comply with guidelines of general data protection (GDPR) and insurance distribution (IDD), the data is easily summarised and visually represented in customisable analytics dashboards.

Behavioural insights

The main purpose of an expert chatbot is to manage a conversational process. Whilst doing so, expert chatbots take a step further in order to enable continuous improvement. By being equipped with multiple sensors, they are able to detect how customers are interacting with the conversational process offered. For example, it’s possible for a business to know what specific conversational journey a customer had, how much time customers spend on a particular question etc.

Granular analysis of conversion rate

A traditional webform journey, like quote & buy of an insurance product, is usually divided into 4 steps, each one corresponding to a different webpage (e.g.details, quote, policy, payment). In such a scenario, it’s usually possible to analyse the percentage drop of potential customers between one page and the other. With CPA the game changes. Being based on a chatbot conversation allows knowing how many customers are dropping at a specific part of the journey.

The combination and of the three points above

Through a CPA platform, it is possible to intercross. For example, it’s possible to analyse the conversion rate of a particular customer demographic (e.g. female between 30-40 years old) or analyse the conversational journeys according to the quantitative feedback shared by customers (e.g. TNPS - Transactional Net Promoter Score).

How is CPA different from chatbots?

A chatbot is a computer program that simulates human conversation through voice commands or text chats or both. Today, for the insurance industry as for others, chatbots offer an innovative customer experience in substitution or at the side of traditional communication channels (e.g. phone, email, forms). Their interface is similar to most common messaging applications such as Whatsapp, Messenger, with the substantial difference of a robot (bot) to chat with.

CPA mainly focuses on processes requiring integration and advanced business logic, oftentimes customer-facing. The aim is to keep interacting with customers through an intuitive and personal front-end solution whilst allowing the customer to self-serve in a business process. This isn’t possible with a generic chatbot or a webform. Phones and web chats aren’t feasible either because of the time they take. In other words, CPA augments chatbot capabilities to enable a personal conversational experience into high-value processes at scale and execute tasks that a human would normally do.

On top of this, CPA is powered by a platform designed to analyse conversations and data captured by the chatbot in order to generate knowledge and critical insights about the performance of the process and about the customers subject to it. For example, CPA platforms can highlight which type of customers are selecting a particular coverage option, which time of the day customers are engaging the most, which are the most recurring requests, and where customers dropped the conversation.

The platform often includes machine learning (ML) capabilities to enable continuous improvement. It means that CPA is powered by AI but with different technical skills than conversational AI, as the focus is more on the optimisation of the business performance instead of the conversation itself. In other words, “intelligence” is applied to generate insights based on real customer data - both demographics and behavioural- that inform businesses over the changes to be made in the process, or in the chatbot conversation itself.

To deepen, read the blog How to avoid chatbots' failure with Conversational Process Automation

How is CPA different from Conversational AI?

As the name suggests, Conversational AI mainly focuses on the communication between computers and humans and can be defined as the brainpower that makes machines capable of understanding, processing and responding to human language.

In order to achieve its purpose, Conversational AI platforms make use of various technologies (e.g natural language processing - NLP, machine learning - ML, predictive analytics etc.) aimed at offering the best conversational experience, learning from it and improving it over time.

While Conversational AI focuses uniquely on the performance of chatbot conversations, CPA is primarily concerned with the execution and optimisation of the business processes it covers. In other words, CPA brings the actual capabilities to execute the demands of the customers that require actions outside of the chatbot conversation itself, linking them with backend systems and processes.

Besides, as a side effect, CPA helps businesses to be more performant by nimbly adapting to customer needs through the gathering of structured data and continuous improvement based on analytics and insights available through dashboards.

In summary, CPA foresees the use of conversational interfaces to gather and structure human input, therefore it overlaps with Conversational AI. Also, the uniqueness of CPA is to expand chatbot capabilities by linking them with existing processes, fully or partially automating parts of them. Therefore, it also overlaps with business process automation (BPA).

To deepen, read the blog How Conversational Process Automation and Conversational AI differ

How is CPA different from RPA?

RPA is an application of technology aimed to improve business processes through automation. It normally leverages robots that automate the tasks of existing processes. This ultimately reduces process inefficiencies and improves their performance at a fraction of the cost. The business processes targeted here are middle and back-office processes.

Such robots also eliminate unnecessary human manual input in various steps of the business process. Despite this, RPA has a glaring limitation: very often business processes start with customer-facing interactions. This often translates into unstructured data that RPA is not able to handle.

CPA was born more recently to solve this problem: it focuses on the automation of front-end customer-facing processes. This often implies the use of expert chatbots to enable a personal conversational experience at scale.

Objective number one of CPA platforms is to interpret and understand customers’ unstructured input, structure it and wrap it into a format digestible to robots (e.g. RPA itself) or back-end systems directly (e.g. insurance platforms or other automation platforms).

To deepen, read the blog CPA + RPA: Enable self-service for customers

How is CPA linked to other technologies?

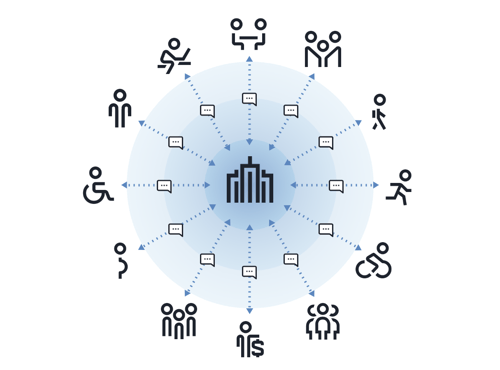

The automation ecosystem is wide with various technologies designed to execute particular tasks and achieve specific goals. In the image below, we consider the world of customer-facing interactions between individuals and businesses in relation to automated solutions.

CPA is automating conversations and processes at the same time reconciling the conversational realm to the business process automation one.

To deepen, read the blog Demystifying automation in insurance

Evolution of insurance channels

Insurance is a highly transactional business process between a customer and a company. Whether a customer is about to enquire, buy, manage an insurance policy or make a claim, the type of interaction boils down to two categories:

- The request of information from customer to insurance company. Usually, this includes questions regarding the policy at all stages of the product. Traditionally, the interaction has been managed through voice, where the information is exchanged through conversation between the two parties.

- The request of information from insurance company to customer. Usually, this involves the collection of data from the customer such as personal details or details about the insured item. The interaction is more written in this case and takes the shape of a structured form.

Originally, the conversation between a customer and an insurance company was managed through face-to-face interactions. To address the challenges related to the need for physical presence and limited availability during office hours, insurers evolved through the setting up of call centres. Call centres can provide a good interaction but they saturate quickly causing customers to wait. Web live chat appeared in the market in the last few years as a solution to limit saturation at a lower cost. Yet, they suffer from the same problem since the number of simultaneous conversations for an agent is still limited.

While the data varies for every customer, the collection process is very similar. This is why insurance companies set up forms at different stages (e.g. getting a quote or making a claim). With the digital revolution, the paper form has evolved into webforms and web portals. These provide short-term cost-savings opportunities by automating processes that were once performed manually. Yet, they provide a dry, impersonal, and untailored customer experience. Web forms lack not only the business logic required for the execution of insurance processes but also have difficulty in delivering a user-friendly customer experience across devices from laptop to mobile.

CPA appeared in the market to solve the current challenges and limitations within the insurance industry. Leveraging technology to deliver automated, intuitive, and personal conversations, the idea behind CPA is ultimately to offer a pleasant experience at scale. It aims to ensure that every conversation between a business and a customer is personal at a fraction of a call centre cost.

40 years ago insurance leaders decided it was time to push their business to the next level by enhancing operational efficiency. Today besides the constant need for operational improvement, customer expectation is raising more than ever. CPA imposes itself as the natural evolution by offering the chance to take two pigeons with one stone.

Is your organisation leveraging automation for customer-facing processes? Are you ready to boost your customer-facing processes with Conversational Process Automation (CPA)?

Take the first step toward automation and claim your Spixii Performance Assessment for free.

Example for Quote & Buy

Within insurance, quote & buy processes are mainly managed through webforms. The main problems related to such digital solution are:

- Lack of responsiveness. Webforms provide a dry and impersonal customer experience whereby customer details are collected in bulk, independently from the customer type or input, resulting in a clunky one-size-fits-all experience. Often customers are asked questions that are irrelevant in consideration of the input they just entered in the previous fields.

- Poor multi-device capability. The webform experience is designed for desktop devices, still working for tablets but not for smaller devices such as mobile phones. On top of that, most of the time the design is not responsive and not adapting to the device size causing the mobile customer a very frustrating experience.

- Low detail of analytics. A traditional webform journey is usually divided into 4 steps, each one corresponding to a different webpage (e.g.details, quote, policy, payment). Few data can be created out of this digital asset. For instance, the conversion rate and the percentage drop of potential customers will be available only between one page and the other.

In contrast, CPA offers a simpler and more personal experience through expert chatbot conversations. The customer enters the insurer’s website and finds the chatbot to interact with. The experience is conversational and natural, though a messaging-like interface, adapting to the customer input and providing clarification of unknown terms including insurance jargon. Depending on the level of automation, payments can be securely performed through the chatbot.

While transactions are executed, expert chatbots fill the CPA platforms with data from each conversation. When the insurer logs in, he will be able to see the result of the quote & buy process with performance details. The platform allows to analyse conversations in depth and highlights improvement opportunities based on customer demographics and behavioural patterns. Through it, it will be possible to see how the chatbot is performing according to demographics, or how individuals are interacting with it, where they are dropping the conversation and suggest reasons why. After insights are generated, AB testing can be easily set up with the ultimate goal of performance optimisation. This process opens the door to further personalisation, with dedicated and more performing journeys according to demographics or device and ultimately, conversion rate optimisation.

See how Spixii partnered with Duck Creek and Blue Prism to offer an end-to-end quote & buy solution.

Example for Policy Administration

Most of the policy administration tasks (roughly 80%) are quite simple and directly manageable by every policyholder. If the insurance company allows self-serve, such tasks can be easily performed by customers, without any input from its operators and without exposing policyholders to unnecessary queues over the phone.

Among the most common tasks, there is the update of policy details, request of policy details or next payment to perform. As an example, let’s say a policyholder recently changed his residence address. With CPA implemented into the insurer’s system, the policyholder can initiate a conversation with a chatbot from the insurer’s website and ask to change the address related to his policy. If the expert chatbot is connected with the policy system, such policy update will be performed without any input from operators. If instead, the request from the policyholder is more complex, it can be routed to a human, who will find details about the conversation along with the task to perform.

See how Spixii partnered with Duck Creek and Blue Prism to offer an end-to-end quote & buy solution.

Example for Claims

There are multiple steps within a traditional claim process including notification of loss, validation of the claim, assessment adjudication and payout. Because the process is mostly managed by claim handlers, the process will require long processing times often increased by lack of efficiency across the pipeline, increasing policyholders anxiety and reducing their opinion over their insurance provider. How can CPA help with improving this process?

An expert chatbot is implemented within the insurance company website and manages conversations with customers 24/7/365. When integrated with the insurer’s policy system (usually through API), the chatbot is able to authenticate the policyholder. Different levels of security can be applied from simple authentication to two-step systems with email verification. The policyholder engages in a slick and simple conversational experience and is able to complete his first notification of loss (FNOL) with all the information related to his claim, including media assets such as photos, videos or documents.

Direct feedback from the policyholder can be collected both in qualitative (e.g. verbatim feedback) and quantitative format (e.g. TNPS - Transactional Net Promoter Score or CSAT - Customer Satisfaction).

Depending on the insurance business’ ecosystem, further automation can be applied. The expert chatbot, when powered with CPA processes, can directly open claims within the insurer’s claim system but is also able to recognise simple “fast-track” claims and potentially settle them with or without human supervision.

Therefore through CPA, the insurer can potentially route complex claims to human, simpler ones to touchless journeys and possibly extend the conversation with a group of customers to offer additional information or services.

Simultaneously, the conversational data gathered by the expert chatbot are stored in the CPA platform and ready to be analysed. The performance of the chatbot is now visible through graphs: behavioural patterns are identified, conversations can be analysed at a granular level according to demographics and feedback processes in a single space. The conversational experience can then be reiterated according to such data-driven insights.

See how Spixii partnered with Duck Creek and Blue Prism to offer an end-to-end quote & buy solution.

Example for Customer Service

Similarly to Policy Administration, Customer Service usually consists of very simple and recurring queries (roughly 60% of requests). Normally, such questions are either answered within website pages (e.g. FAQ systems) or delegated to call centres. Most of the time customers and policyholders end up queuing on the phone decreasing the insurer’s esteem.

CPA can employ expert chatbots within insurers’ web pages to deal with most of the customer queries. The chatbot is able to provide instant answers and of course available 365/7/24 when call centres are not. When queries are complex, they can be routed to a human operator that can better deal with them.

CPA and data protection

Insurance businesses collect and process a huge amount of data. While it can be used to inform decision-making, optimise the performance of processes, mitigate risk and meet increasing customer expectations, data is also critical for regulatory purposes.

Insurance is one of, if not the most regulated industry. Therefore, good data governance and practice is expected to be in place as part of every insurer’s compliance program. This not only means alignment with general data protection (GDPR) guidelines but more strictly to the insurance distribution directive (IDD) as well.

In order to comply with the high standards defined by such regulators, it is mandatory for every insurance business to have a coherent data and analytics strategy along with a solid data governance framework with transparent and fully auditable data management standards and controls.

At Spixii, the CPA platform is based on a fine-grained access control (FGAC) framework to guarantee security at a granular data level. Each data item has its own access control policy with fully customisable access to it. Such a strategy empowers insurers to control and set different data access for their employees or third party companies according to their function and their level of responsibility.

When it comes to data storage, Spixii CPA platform adopts different data strategies:

- Data minimisation: Spixii CPA reduces sensitive data to collect and store to the bare minimum

- Data anonymisation: all the information collected through Spixii expert chatbots is unidentifiable to an individual or entity

- Data retention: Spixii CPA features data policies with deletion of sensitive data with totally flexible timings according to its client needs

On top of this, Spixii CPA platform applies data segregation with the FGAC framework to secure each insurer's data in a separate database.

A thorough and deep comprehension of data regulations was required to bring the Spixii CPA platform to an enterprise level. But also the ISO 27001 certification, periodically renewed by the Company, made a great impact in increasing the security of the software solution and data protection.

In particular, the ISO standard recommends performing scans of vulnerabilities, penetration tests, static and dynamic security analysis of the application and continuous review of the OWASP reports.

More details of Spixii certifications are available on the Compliance and Security webpage.

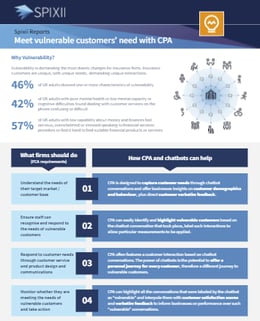

Addressing FCA’s priorities with CPA

Vulnerability is one of the most discussed topics in the insurance industry and one that is demanding the most drastic changes for insurance firms.

According to the FCA’s Financial Lives 2020 Survey, there are 27.7 million adults with characteristics of vulnerability in the UK, meaning more than half of the adult population (53%), giving reason to FCA’s urgency about protecting vulnerable customers.

In the table below, FCA’s high-level vulnerability principles are reported together with the concrete ways in which chatbot technology and Conversational Process Automation (CPA) can uphold those principles and meet requirements.

| What firms should do (FCA requirements) | How CPA and chatbots can help |

| Understand the needs of their target market / customer base | CPA is designed to capture customer needs through chatbot conversations and offer businesses insights on customer demographics and behaviour, plus direct customer verbatim feedback. |

| Ensure staff can recognise and respond to the needs of vulnerable customers | CPA can easily identify and highlight vulnerable customers based on the chatbot conversation that took place and label such interactions to allow particular measurements to be applied. |

| Respond to customer needs through customer service and product design and communications | CPA often features a customer interaction based on chatbot conversations. The power of chatbots is the potential to offer a personalised journey for every customer. Therefore, a vulnerable customer would have every interaction exclusively tailored to them. |

| Monitor whether they are meeting the needs of vulnerable customers and take action | CPA can highlight all the conversations that were labeled by the chatbot as “vulnerable” and interpole them with customer satisfaction scores and verbatim feedback to inform businesses on performance over conversations with vulnerable customers. |

Grab your Spixii vulnerability one-pager report

Get the Spixii one-pager with an overview of FCA's 2021 requirements for vulnerable consumers and how Conversational Process Automation (CPA) and expert chatbots can help complying with them.

Michael Sicsic, Spixii advisory board member and former head of supervision at the FCA said:

Firms struggle most with design and organisation change necessary to identify, track and use the most relevant customer information. Communications to vulnerable customers needs to be tailored –with different trigger points and different wording according to circumstances. The more information a customer shares, the better the organisation is able to respond, and mitigate the impacts of a customer’s degree of vulnerability.

At the same time, relevant data on vulnerability must be systematically collected and recorded so it can be used by frontline staff. Chatbots and Conversational Process Automation (CPA) can support insurance firms to achieve both goals, the best customer and business outcomes.

As a tangible example, in 2018, Spixii designed a multi-award winning expert chatbot system called Zara for Zurich UK to help them manage their claims. Anne’s entire testimonial using the expert chatbot can be viewed below where she also explains the context of filing for the claim.

To deepen, read the blog How insurers can meet the needs of vulnerable customers with CPA and chatbots

Start the conversation

Discuss your business needs with the Spixii team and discover how the Spixii CPA Platform can help you accelerate the automation of your high-value processes.